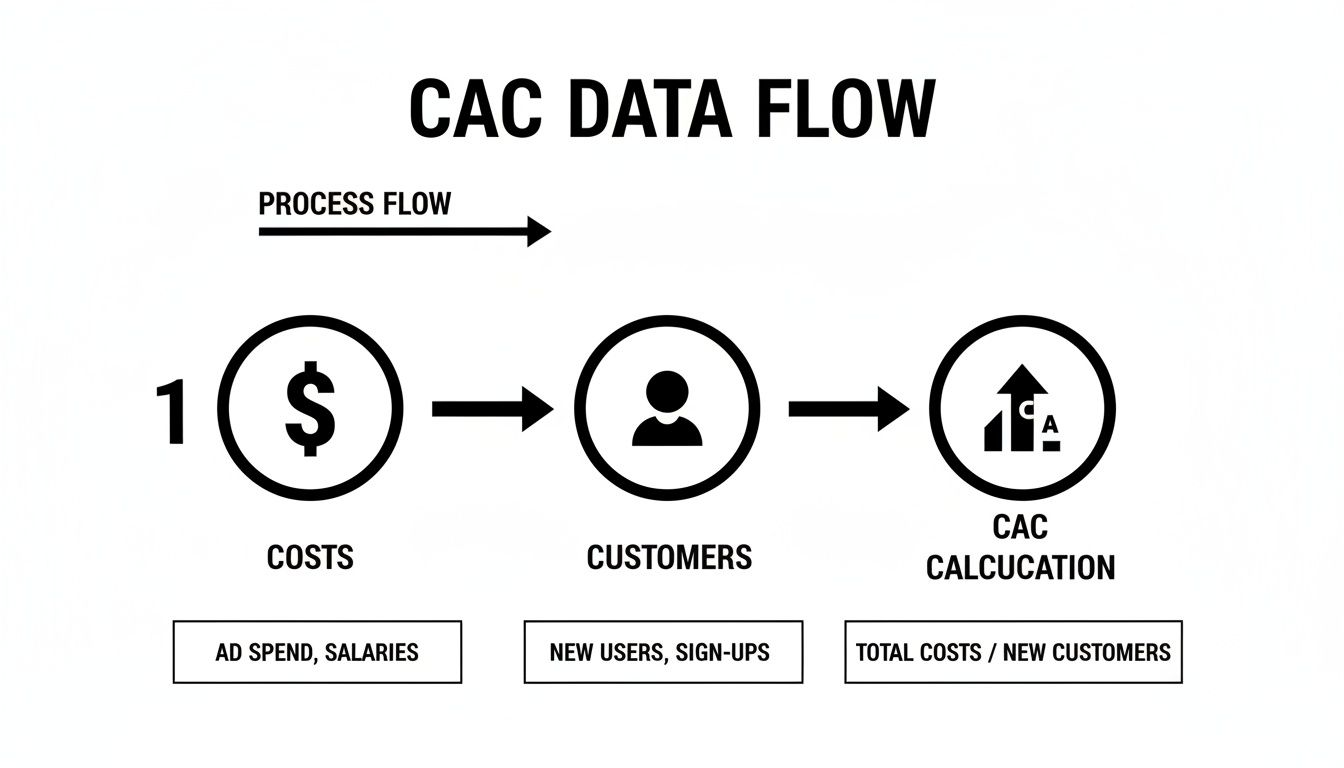

A customer acquisition cost calculator is a straightforward tool. You plug in your total marketing and sales costs, divide by the number of new customers you brought in over a certain period, and voilà—you get your CAC. But beyond the simple math, this number tells a story about whether your business model is built to last, especially in how you rank on search engines and connect with your audience.

Why Your CAC Is More Than Just a Number

Before you fire up a spreadsheet, let's get one thing straight. Your Customer Acquisition Cost (CAC) isn't just another metric for your dashboard. It’s a direct pulse check on the health of your business and a critical chapter in your growth story.

Ignoring your CAC is like driving without a fuel gauge. Sure, you're moving, but you have no clue when you’re about to sputter to a halt.

Think about the classic startup story. A small ecommerce brand, flush with early funding, goes all-in on paid ads. Sales are booming, revenue charts are pointing up. Looks like a success story, right? But under the surface, their CAC is a runaway train. They're spending $100 to land a customer who only makes a $75 purchase. This isn't growth; it's a cash-burning machine. This is why you need to get intimate with your CAC—it forces you to ask hard questions and tell a smarter story about your strategy.

The True Meaning Behind the Metric

Your CAC tells you a lot more than whether a campaign was a hit or a miss. It gives you a clear window into some of the most fundamental parts of your business.

- Profitability and Viability: A high CAC can demolish your profit margins, making it impossible to scale without going broke.

- Marketing Channel Performance: It helps you pinpoint which channels—like organic search (SEO), paid ads, or social media—are actually pulling their weight and delivering a real return.

- Investor Confidence: Smart investors don't just look at revenue. They look at the relationship between CAC and Customer Lifetime Value (LTV) to see if your growth engine is built to last. A healthy ratio is proof that your model works.

The cost of getting a new customer has become a massive headache for businesses everywhere. Over the last decade, these costs have shot up, with one report showing a staggering 222% increase between 2013 and 2025.

This surge means brands are now losing an average of $29 for every new customer they acquire, a huge jump from a $9 loss in 2013. The main culprits? Saturated digital ad markets and cutthroat competition. You can dig into more of the data on these rising costs in this comprehensive report.

Introducing the LTV to CAC Ratio

Knowing your CAC is only half the battle. The metric truly comes to life when you pair it with Customer Lifetime Value (LTV)—the total amount of money you expect to make from a single customer over their entire relationship with you. The LTV to CAC ratio is the ultimate gut check for sustainability.

A healthy business typically aims for an LTV:CAC ratio of at least 3:1. This means for every dollar you spend getting a customer, you're getting at least three dollars back over their lifetime.

Getting this balance right is the foundation of scalable growth.

For example, many companies discover that investing in SEO for startups delivers a much healthier LTV:CAC ratio in the long run compared to just pouring money into paid ads. A strong organic presence built through SEO brings in a steady stream of high-intent customers who are already searching for a solution, which naturally pushes down acquisition costs over time. This isn't just about ranking; it's about telling a consistent story that builds trust and attracts the right people.

Nailing the Numbers: Gathering the Right Data for an Accurate CAC

Your customer acquisition cost calculation is only as good as the data you feed it. Garbage in, garbage out. One of the most common mistakes is using incomplete numbers, which creates a dangerously false sense of security. It makes you think your marketing is crushing it when it might actually be bleeding money.

To get a true picture of your CAC, you need to meticulously track two things: your total sales and marketing costs, and the actual number of new customers you brought in over a specific period. This goes way beyond just glancing at your ad spend.

Uncovering Your True Sales and Marketing Costs

Think of this as a complete financial audit of your customer acquisition efforts. So many businesses just tally up their Google Ads or Facebook Ads budget and call it a day. That’s a surefire way to severely underestimate your real CAC.

To do this right, you have to account for every single dollar that contributes to winning a new customer.

Don't Forget These Hidden Costs

- Salaries and Benefits: The paychecks for your marketing team, your sales reps, and even a percentage of your content writers' or designers' time. They're all part of the acquisition engine.

- Software Subscriptions: All those monthly fees add up. We're talking about your CRM (like Salesforce), email marketing platform (like Mailchimp), analytics tools, and any SEO software you rely on.

- Agency and Freelancer Fees: Are you paying a PPC agency, an SEO consultant, or freelance writers? That all goes into the pot.

- Content Creation Costs: Any budget you put toward producing blog posts, videos, podcasts, or other marketing assets needs to be counted.

- Overhead Costs: A fair portion of the office rent and utilities that support your sales and marketing teams has to be included, too.

Let’s put this into perspective. Say you spent $10,000 on Google Ads last month. But you also paid $5,000 in marketing salaries, $1,000 for your CRM and email tools, and another $2,000 to a content agency. Your total cost isn't $10,000—it's actually $18,000. Ignoring that extra $8,000 will give you a CAC that’s wildly off base and completely misleading.

Defining and Counting Your New Customers

The other half of the equation seems simple on the surface: count how many new customers you got. The keyword here, though, is "new." Lumping repeat buyers in with new acquisitions is another frequent slip-up that artificially tanks your CAC.

You need a crystal-clear, consistent definition of what a "new customer" is for your business. Is it someone making their very first purchase? Or maybe a user who signs up for a trial and then converts to a paid plan? Whatever you decide, it has to be the same across all your tracking systems.

A new customer should be defined as an individual or entity making their very first purchase or conversion. Confusing repeat business with new acquisitions will mask inefficiencies in your top-of-funnel strategy.

Getting this right is non-negotiable. Your CRM should be your source of truth here, allowing you to easily filter out existing customers from any acquisition reports. This precision ensures you're measuring how effective you are at attracting brand-new business, which is exactly what the CAC metric is for.

Properly setting up your tracking is essential. For many businesses, a deep dive into analytics for paid search is a great starting point. It can reveal precisely which campaigns are bringing in genuinely new customers versus those that are just re-engaging people who already know you. This level of detail ensures your CAC is built on a foundation of clean, reliable data—giving you insights you can actually trust to make smart budget decisions.

How to Build Your Own CAC Calculator

Ready to roll up your sleeves? It's time to build the one tool that will give you a real-time pulse on your marketing efficiency. While embeddable calculators are fine for a quick look, building your own in Google Sheets or Excel gives you total control and a much deeper feel for the numbers actually driving your business.

Let's move past the theory and build a practical, powerful customer acquisition cost calculator right now.

The core formula is deceptively simple: (Total Marketing & Sales Costs / Number of New Customers Acquired). The real magic happens when you start breaking down those costs and looking at performance channel by channel. This is how you transform a simple metric into a strategic roadmap that tells you which parts of your marketing story are resonating most.

Structuring Your CAC Calculator Spreadsheet

First things first, open a new spreadsheet. The idea is to create a template you can just copy and reuse every month or quarter. This consistency is absolutely essential for spotting trends and seeing if your optimization efforts are actually paying off.

Your calculator needs two main sections: one for all your expenses and another for tracking the new customers you've brought in. Keeping these separate makes the whole thing cleaner and easier to update when you're in a hurry.

Here’s a simple structure to get you started:

- Column A: List out every single expense category. Think Google Ads spend, SEO agency fees, marketing team salaries—get granular.

- Column B: Drop in the dollar amount for each expense for the period you're measuring (like Q1).

- Separate Section: Have a single, clear cell for "Total New Customers Acquired" for that same period.

This visual flow shows exactly how your costs and new customer numbers funnel down into your final CAC.

The key takeaway here is its brutal simplicity: every single dollar you spend on sales and marketing has to be justified by the customers it brings through the door.

A Real-World SaaS Company Example

Let’s make this real. Imagine a B2C SaaS company wants to figure out its CAC for the first quarter (Q1). They’ve pulled all their expense reports and customer data, and now they're ready to plug everything into their new calculator.

To see how this works in practice, let's break down the costs for a fictional SaaS business in Q1. This table lays out all the moving parts needed for the calculation.

| Expense Category | Cost | Metric | Value |

|---|---|---|---|

| Google Ads Spend | $15,000 | Total New Customers Acquired | 250 |

| Facebook Ads Spend | $10,000 | ||

| SEO Content Writer (Freelancer) | $4,500 | ||

| Marketing Manager Salary (Q1 Portion) | $18,000 | ||

| CRM & Marketing Automation Software | $1,500 | ||

| Total Costs | $49,000 | Overall CAC | $196 |

After adding everything up, their Total Marketing & Sales Cost for the quarter lands at $49,000.

Next, they run a report in their CRM and see they signed up 250 brand-new paying customers during that same three-month window.

Using the formula, their math is simple: $49,000 / 250 = $196. So, their blended CAC for Q1 is $196. This number is their new baseline. They now know it costs them, on average, just under $200 to acquire a new subscriber.

Calculating CAC by Individual Channel

This is where your calculator really starts to earn its keep. A blended CAC is useful, but a channel-specific CAC is truly actionable. It tells you exactly where your budget is pulling its weight, helping you make much smarter decisions about where to double down.

To do this, we need to break down the SaaS company's numbers by channel. This means you have to be able to attribute new customers to their original source—a task where tools like Google Analytics become indispensable.

Knowing your channel-specific CAC is the difference between blindly spending money and strategically investing it. It reveals which channels are building long-term, cost-effective growth engines for your business.

Let's assume that out of their 250 new customers:

- 120 came from Google Ads

- 80 came from Facebook Ads

- 50 came from organic search (SEO)

Now we can calculate a specific CAC for each one. To be accurate, we also need to attribute a portion of the "soft costs"—like salaries and software—to each channel.

-

Google Ads CAC: We'll attribute the direct ad spend ($15,000) plus a chunk of the overhead (let's say 40% of salaries/software, which is $7,800).

- Calculation: ($15,000 + $7,800) / 120 = $190

-

Facebook Ads CAC: We'll use the Facebook spend ($10,000) and another piece of the overhead (we'll attribute 30%, or $5,850).

- Calculation: ($10,000 + $5,850) / 80 = $198

-

Organic Search (SEO) CAC: Here, the direct cost is the freelancer ($4,500) plus the remaining overhead (30%, or $5,850).

- Calculation: ($4,500 + $5,850) / 50 = $207

At first glance, it seems like SEO is their most expensive channel. But this is where the story gets interesting. Paid ad costs are volatile and disappear the moment you stop paying. The content created for SEO, on the other hand, is an asset. It will keep acquiring customers for months or even years, effectively driving that channel's CAC down over time. This single insight is often all you need to justify a long-term investment in content and SEO.

Making Sense of Your CAC with Industry Benchmarks

So you've built your customer acquisition cost calculator, punched in all the numbers, and now a final CAC is staring back at you from the spreadsheet. Great. Now what?

The big question is always the same: is this number good or bad?

The honest answer? It depends. A CAC of $200 could be a fantastic win for one business and a complete disaster for another. Context is everything. To start building that context, you need to see where you stand within your industry. Comparing your number to established benchmarks is the first crucial step in turning your CAC from a simple metric into a strategic weapon.

Why CAC Varies So Drastically by Industry

You simply can't compare a B2B SaaS company's acquisition cost to a local coffee shop's. The business models, sales cycles, and customer expectations are worlds apart, which naturally leads to massive differences in what’s considered a "healthy" CAC.

Several key factors drive these variations:

- Sales Cycle Length: A B2B software company might have a six-month sales cycle that involves multiple demos and stakeholder meetings. That's a long, hands-on process that inevitably drives up costs compared to an ecommerce store selling t-shirts, where a customer can buy something in minutes.

- Product Complexity and Price Point: Selling a $50,000 piece of industrial equipment requires a whole lot more marketing and sales effort than selling a $50 subscription box. The higher the price and complexity, the more education and trust-building it takes to close the deal.

- Customer Lifetime Value (LTV): Industries with high LTV, like telecommunications or finance, can justify a much higher CAC. They know they'll make that money back (and then some) over a long customer relationship. A business with low repeat purchase rates needs a much tighter grip on its acquisition costs from day one.

- Market Competition: A crowded market means more companies are bidding on the same keywords and fighting for the same audience's attention. This drives up advertising costs across the board and inflates the CAC for everyone involved.

Finding Your Place with CAC Benchmarks

Looking at industry-specific data gives you a much more realistic framework for setting goals. For instance, recent benchmarks show just how wide the disparities can be. The electronics sector often sees the highest CAC at around $377 per customer, which makes sense given the high cost of marketing complex, high-ticket tech products.

On the other end of the spectrum, industries like arts and entertainment report much lower acquisition costs, sometimes as low as $21. Sectors like health, beauty, fashion, and home goods tend to fall somewhere in the middle, with CACs typically ranging from $120 to $130. You can explore more insights about CAC benchmarks on Genesys Growth to see how different verticals stack up.

Understanding these benchmarks isn't about finding a number to perfectly match. It's about establishing a realistic baseline to gauge your own performance and identify opportunities for improvement.

The Impact of Location on Your Costs

It’s not just your industry that matters—where you do business plays a significant role, too. This is where a focus on Geographic SEO (GEO) becomes critical.

Regional advertising costs can have a huge impact on your numbers. Running a Google Ads campaign in a major hub like New York City or Los Angeles is going to be far more expensive than running the exact same campaign in a smaller, less competitive market. Your GEO strategy helps you own your local turf on search engines without paying a premium for every click.

This is especially critical for local service businesses or any company with a geographic focus. Your "good" CAC needs to be benchmarked not just against your industry nationally but also against the specific economic realities of your target locations. By understanding these layers of context—industry, LTV, and geography—you can move from simply calculating your CAC to strategically managing it.

Proven Strategies to Lower Your Acquisition Costs

Knowing your customer acquisition cost is one thing. Actually doing something about it is where the real money is made. The impulse is often to just throw more cash at paid ads, but that's a quick fix that rarely lasts.

If you want long-term profitability and a business that isn't completely dependent on ad platforms, you need to build a powerful organic acquisition engine. This is all about attracting customers who are already looking for what you offer by ranking on search engines and telling compelling stories.

We're going to break this down into three core pillars that help you rank: Search Engine Optimization (SEO), Geographic SEO (GEO), and Answer Engine Optimization (AEO).

Master Search Engine Optimization to Attract Ready-to-Buy Customers

SEO is the absolute bedrock of a low-CAC strategy. Instead of paying to interrupt people, you show up at the exact moment they need you. The entire game is about creating genuinely valuable content that earns top spots on Google for the keywords your ideal customers are searching for every single day.

Let's tell a story. Imagine you run a local bakery famous for its gluten-free cakes. Your customers aren't just Googling your brand name. They're searching for "best gluten-free birthday cake near me" or "bakery that delivers allergy-friendly desserts." SEO is how you ensure your website appears right when they're hungry. It’s a long game, but the payoff is a loyal customer base.

To make this work, you need a few key pieces in place:

- Keyword Research: Pinpointing the exact phrases and questions your audience types into Google.

- High-Quality Content: Crafting blog posts, guides, and landing pages that answer those search queries better than anyone else online.

- Technical SEO: Making sure your website is fast, secure, and easy for Google to crawl and understand.

A top-ranking blog post is an asset that can bring in customers for years with almost no ongoing cost. That's the difference between renting an audience with ads and building a permanent home for them. This creates a compounding effect, steadily driving down your CAC as your site's authority grows.

Dominate Local Search with Geographic SEO

For any business serving a specific area—think dentists, roofers, or retail shops—Geographic SEO (GEO) is not optional. This is how you win the "near me" searches that drive real foot traffic and local leads. It’s about telling your local story to Google.

The cornerstone of any GEO strategy is an optimized Google Business Profile (GBP). This is your digital storefront on Google Search and Maps, and it's often the first impression a local customer has of your business. Keeping it loaded with up-to-date info, great photos, and a constant stream of positive reviews is how you build trust and get seen.

An optimized Google Business Profile isn't just a listing; it's your most powerful local marketing tool. It directly tells Google you are a relevant, trustworthy, and active business in your community, which is essential for ranking in the local map pack.

Don't underestimate how much location impacts acquisition costs. Projections for 2025 show the average ecommerce CAC is around $70 globally, but intense competition in certain areas can send that number soaring. For example, ecommerce companies on the U.S. West Coast often see CACs 15–25% higher than the national average simply due to market saturation. A sharp GEO focus helps you cut through that noise without breaking the bank.

Capture High-Intent Users with Answer Engine Optimization

The way people search is changing. More and more, queries are phrased as direct questions, especially with voice assistants like Siri and Alexa. Answer Engine Optimization (AEO) is all about structuring your content to provide direct answers, aiming to snag those coveted featured snippets and "People Also Ask" boxes on Google.

Think about it from your customer's perspective. They aren't just typing keywords; they're asking for help. They're asking for a story with a solution.

- "What is the best CRM for a small business?"

- "How much does it cost to replace a roof?"

- "What are the benefits of professional teeth whitening?"

By using clear headings and providing concise, direct answers, you make it incredibly easy for search engines to grab your content and feature it at the top of the page. This doesn't just drive highly qualified traffic; it instantly positions your brand as an authority. Winning a featured snippet is a shortcut to earning customer trust and can dramatically lower your CAC.

While organic strategies require patience, they build a resilient and cost-effective way to grow your business. The real magic happens when you pair these efforts with smart, targeted paid campaigns. Our guide on optimizing paid media campaigns can help you strike that perfect balance and maximize the return on every dollar you spend.

Common Questions About Calculating CAC

Even with a solid customer acquisition cost calculator, the real world always throws a few curveballs. This is where theory crashes into the messy reality of running a business. Nailing your CAC often means learning to navigate the gray areas and making some smart judgment calls.

Let's dig into the most common questions that pop up. My goal is to give you clear, practical answers that help you sidestep the usual pitfalls and really put your CAC analysis to work.

How Often Should I Calculate My CAC?

There's no single right answer here—it really hinges on your business model and how long your sales cycle is. But I can give you a pretty solid guideline to start with.

- Monthly: For most ecommerce brands and SaaS companies with quick sales cycles, this is the perfect rhythm. Calculating monthly lets you spot trends fast, see the immediate ripple effects of new campaigns, and change course before a small issue snowballs.

- Quarterly: If you're in B2B with a longer sales cycle—think 60-90 days or more—a quarterly calculation usually makes more sense. It gives your marketing and sales efforts enough breathing room to actually mature and turn into revenue, giving you a much more stable and less reactive picture.

- Annually: While you should definitely be checking in more often, an annual review is non-negotiable. This is where you zoom out for high-level strategic planning and set the budget for the year ahead.

The most important thing? Consistency. Pick a timeframe that works for you and stick to it. That's how you build a reliable historical record to benchmark against and set goals you can actually hit.

What Is a Good CAC Payback Period?

Your CAC payback period is simply how long it takes for a new customer to generate enough profit to cover what you spent to acquire them. This is a critical health metric because it's tied directly to your cash flow. The shorter the payback period, the faster you get your money back to reinvest in growth.

A common benchmark for a healthy payback period is under 12 months. For SaaS businesses, this is a particularly strong signal that you've got a scalable, efficient model.

If your payback period is creeping past 18 months, that could be a red flag. It might mean your CAC is too high, your pricing is too low, or you have a churn problem. Driving this number down is just as crucial as lowering your overall CAC.

Should I Include Both Paid and Organic Costs?

Yes. Absolutely. This is one of the most common—and costly—mistakes I see businesses make. You need a "blended" CAC that rolls up all marketing and sales expenses from all channels. It’s the only way to get an honest look at what it truly costs you to land a customer.

Some marketers try to pull paid and organic costs apart to make their preferred channels look better, but that's just smoke and mirrors. Here’s why including everything is so important:

- Salaries are a very real cost: Your SEO manager and content writers are a core part of your customer acquisition machine. Their salaries have to be factored into the cost of bringing in organic customers.

- Tools and software add up: Don't forget about the subscription fees for your SEO tools, CRM, analytics platforms, and everything else in your stack. It's all part of the acquisition overhead.

- Organic isn't free: It might not have a direct ad spend attached, but a powerful organic presence is built on major investments in time, talent, and technology.

If you ignore these "soft" costs, you'll end up with a dangerously inflated view of your organic channel's ROI. The only way to make a true apples-to-apples comparison between SEO and paid ads is to attribute all the associated costs to each channel.

How Do SEO and AEO Impact My CAC Calculation?

Thinking about SEO (Search Engine Optimization) and AEO (Answer Engine Optimization) is a game-changer for any business trying to build a sustainable growth model. These strategies are all about attracting high-intent customers organically by ranking on search engines, which has a massive long-term impact on your CAC.

When you invest in creating genuinely helpful content that answers your audience's questions, you're not just running a campaign—you're building an asset. A single blog post that ranks well can keep bringing in new customers for years, all for the one-time upfront cost it took to create it. This is the story of sustainable growth.

Here’s how that story plays out in your customer acquisition cost calculator:

In the beginning, your organic CAC might actually look high. You're pouring money into content and optimization without seeing an immediate flood of new customers. But stick with it. Over time, as that content starts to rank and pull in a steady stream of organic traffic, the number of new customers you get from search will grow while your costs stay relatively flat.

This is what causes your organic CAC to drop—often dramatically—over the long haul. And that's the ultimate goal: creating a predictable, low-cost acquisition channel that isn't at the mercy of rising ad prices. It’s the clearest path to improving profitability and building a more resilient business.

Ready to stop guessing and start building a more profitable acquisition strategy? The team at Jackson Digital combines expert SEO, paid media, and analytics to help businesses lower their CAC and drive sustainable growth. Request a free performance audit today and discover your biggest opportunities.